This Either Validates or Wrecks Your 2026 Strategy

What will you do in light of this Data?

As I’ve teased, we’re releasing our buyer journey deep dive. B2B buyer behavior has been changing faster than fast fashion. This leaves established and strong companies confused to why channels and tactics are breaking.

You don’t have a sales problem. You don’t have a marketing problem. Hell, not even a “go-to-market problem.”

You have a buyer-understanding problem.

More specifically: you don’t understand how buyers actually buy in 2026. Not how they bought 2 years ago. How they buy now.

Who calls the shots?

How they make decisions

What they read, how and when they use AI in the process

So I went to the source. Sure, I talk to my buyers and listen to calls, but I needed the overarching, global trends. The best research. Real data. Huge sample sizes.

What I found in the sea of BS reports were a few very solid pieces of research:

6sense (4,510 buyers surveyed, 49% VP+)

G2 (1,100+ decision-makers)

Dreamdata (220K customer journeys tracked)

Consensus (6M+ demo interactions)

I’d suggest every B2B CEO, sales leader, and marketer study these.

Problem is... these reports contradict each other. And they’re long reads, to be fair.

So I synthesized them. Made sense of it all. Resolved the contradictions. Boiled everything down to

21 pages. 5 data tables. 14 infographics. Five action items for GTM leaders planning 2026.

Get it here:

But first, let me give you the highlights that’ll either validate what you suspected or completely wreck your current strategy.

The 60% Problem

Here’s the finding that matters most:

60-80% of B2B deals are essentially decided before your sales team ever makes contact.

Not “influenced.” Not “leaning toward.” Decided.

6sense found that 95% of buyers create mental shortlists before engaging vendors. The win rate for vendors who make that Day One list? 80%.

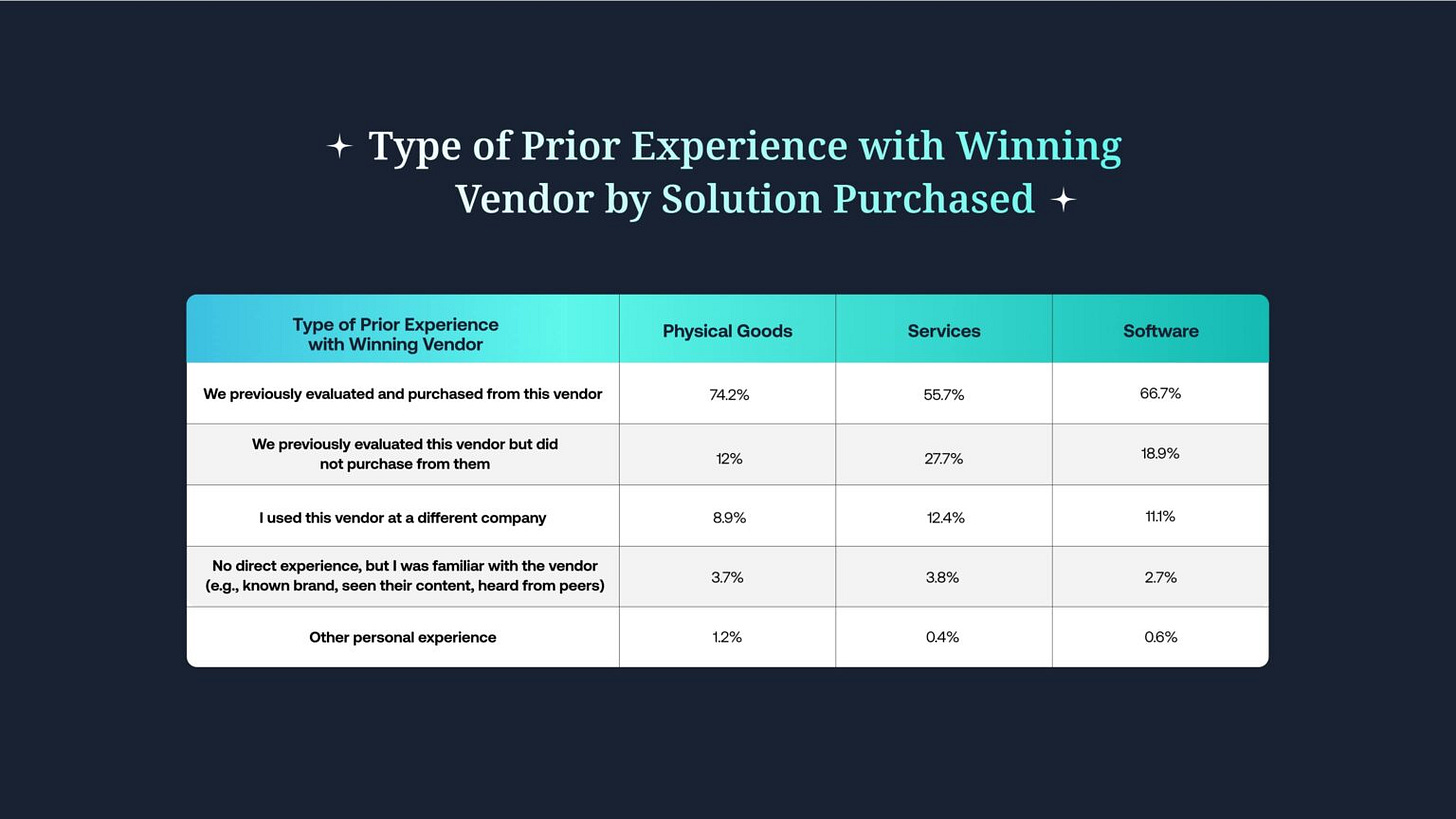

Prior experience with your brand plays a huge role in you making that list. 6sense dug into what types of prior experience count, and to what degree:

If you’re not on that list from the jump, you’re fighting for the remaining 23% of deals. Everything else: your killer demo, your competitive pricing, your charismatic AE - are just theater.

The “No Shortlist” trend (buyers who identify ONE vendor and go straight to purchase) has doubled from 4% to 8% year-over-year. These people never even consider you.

Translation: The battle for revenue happens in channels you probably underfund: review sites like G2, peer networks, LinkedIn, your own content—during a research phase when your CRM shows zero activity.

The 211-Day Marathon (And the 107-Day Death Zone)

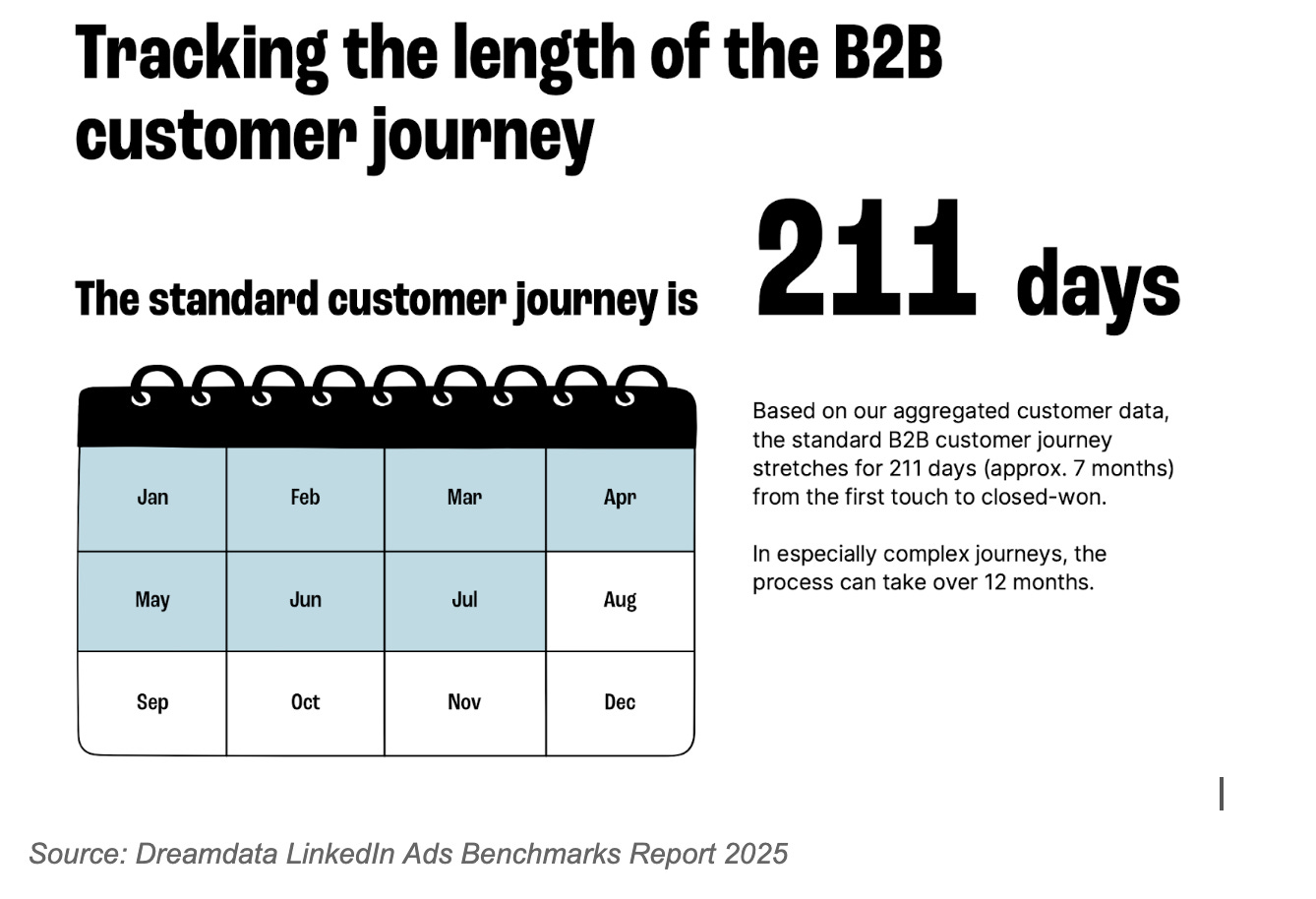

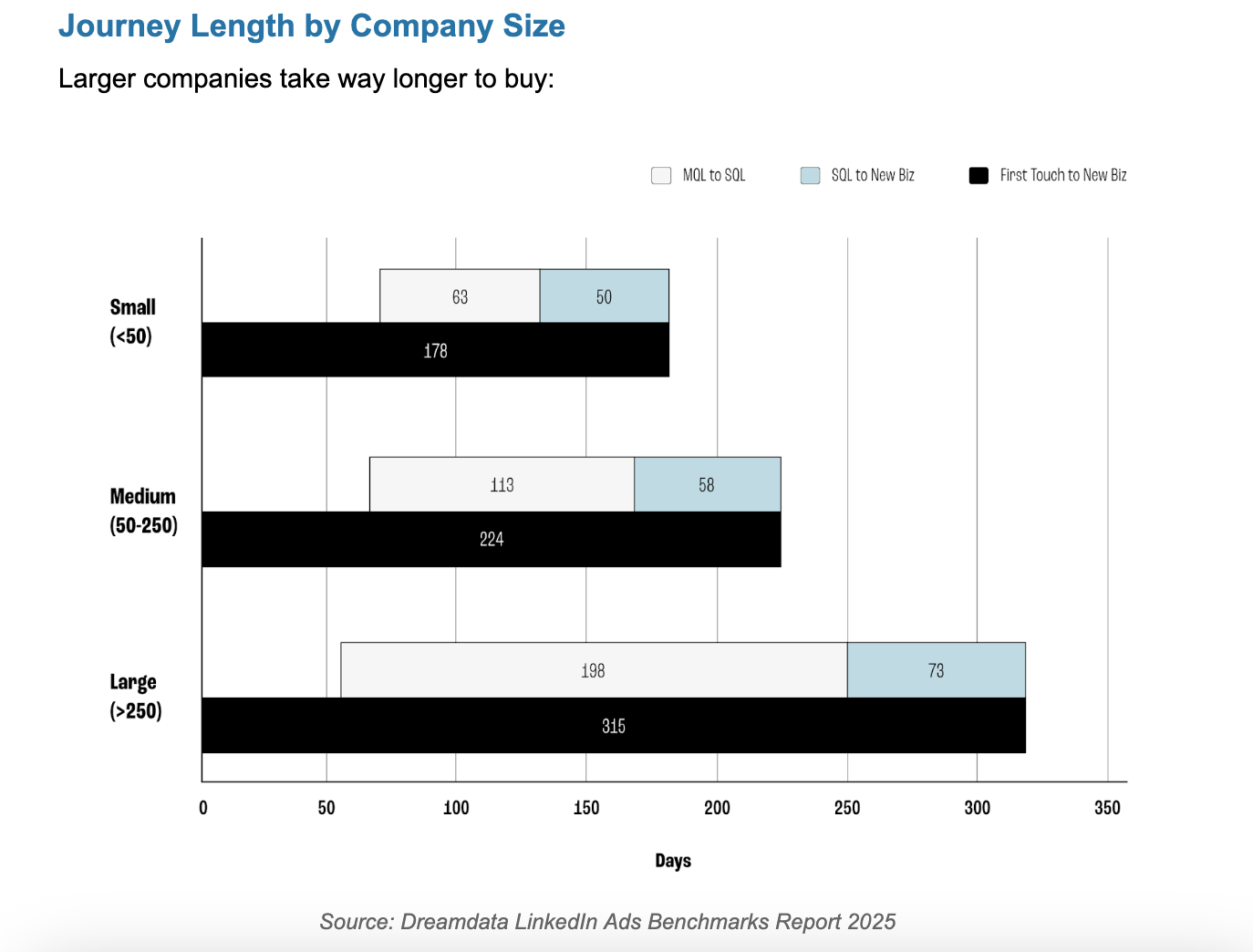

Dreamdata tracked 220,000+ customer journeys. The median time from first touchpoint to closed-won? 211 days. Seven months.

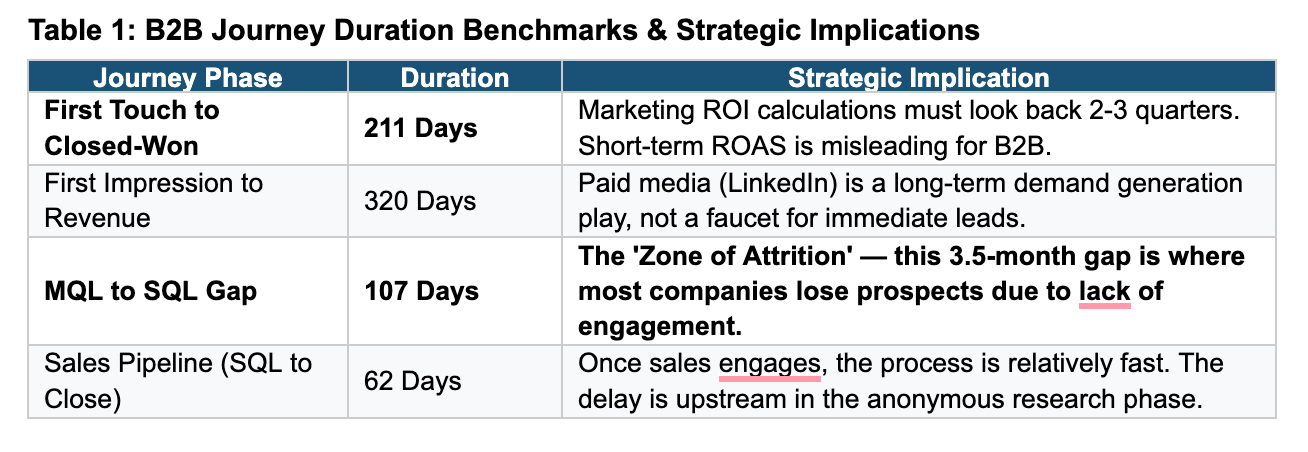

But here’s the killer insight buried in the data: there’s a 107-day gap between MQL and SQL. We call it the Zone of Attrition.

This is where most companies lose deals. Marketing generates a lead, SDRs hammer them for two weeks, no meeting gets booked, lead marked “unresponsive.” Deal dies.

But the buyer isn’t unresponsive—they’re in a research holding pattern. They’ve signaled interest but aren’t ready to buy.

The fix? Stop hiring more SDRs to badger early-stage leads. Build low-pressure nurture infrastructure—newsletters, events, educational content—that sustains brand presence for 3-4 months without burning expensive sales capacity.

And here’s the thing about journey length: it varies massively by company size. Small companies (<50 employees): 178 days. Large companies (>250): 315 days. You need different nurture strategies for different ICPs.

The AI Validation Paradox

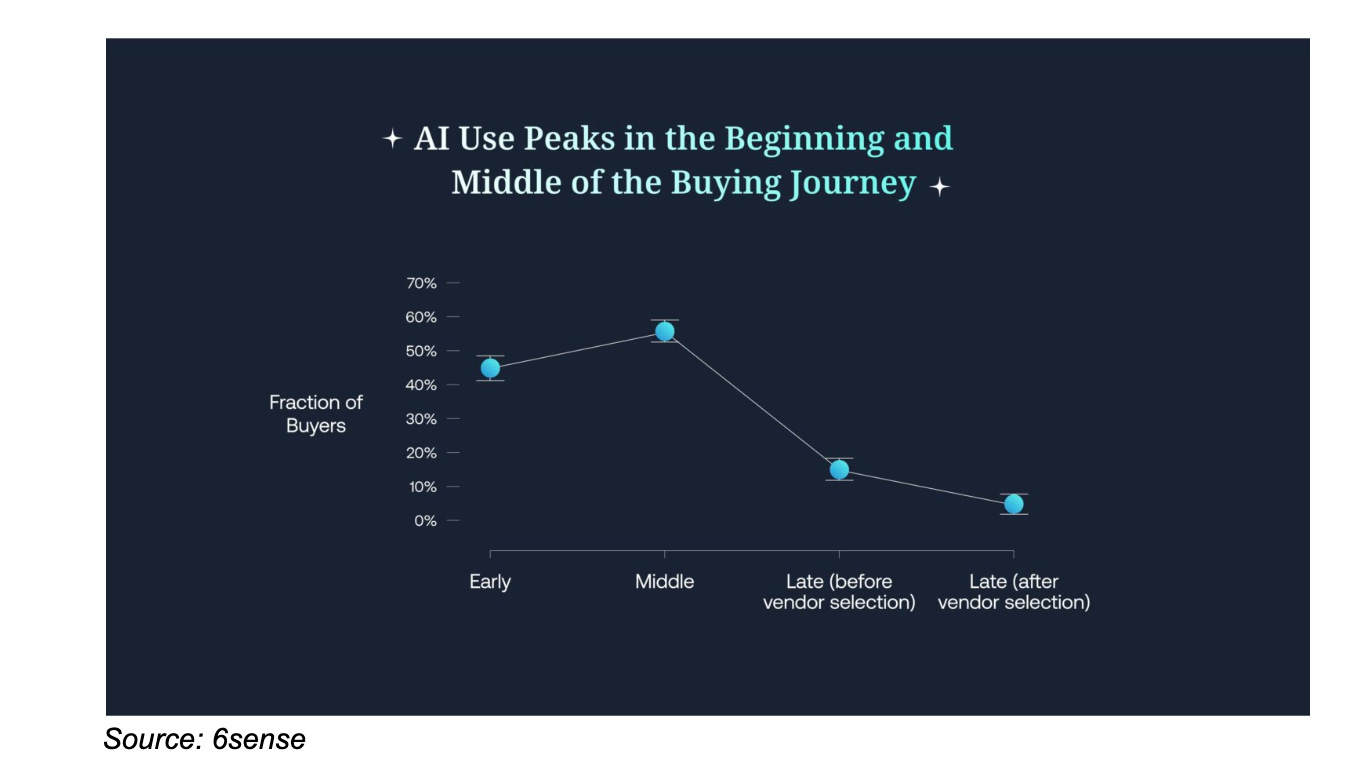

29% of buyers now start their research in AI tools (ChatGPT, Perplexity, Claude) instead of Google. Everyone’s freaking out about this.

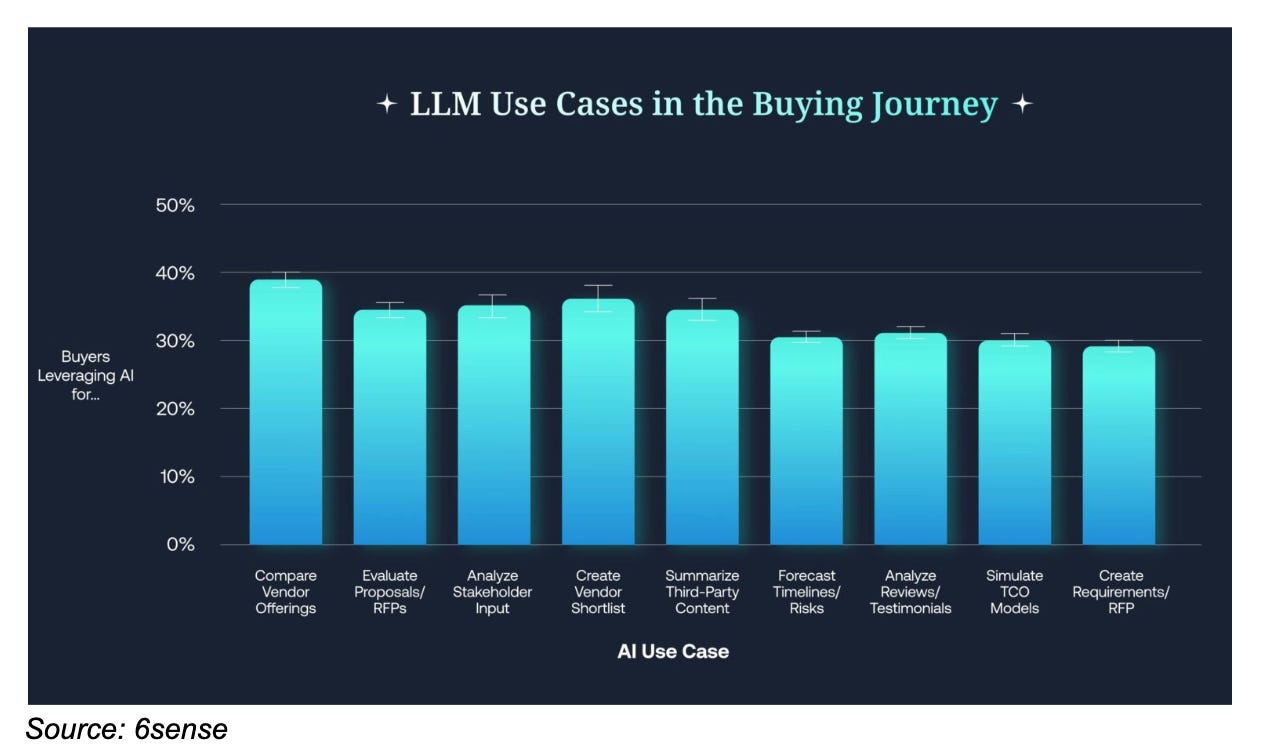

But here’s what the data actually shows: LLM usage peaks mid-journey for comparison and validation, not initial discovery. Buyers already know their options. They’re using AI to validate and compare.

And where do these AI tools get their information? Primarily from software review sites.

Your G2/Capterra presence isn’t just for human readers anymore. It’s feeding the AI that advises buyers. If ChatGPT can’t find consistent, high-rated reviews about your product, you’re being filtered out before a human ever sees your logo.

Where Prior Experience Crushes Everything

Here’s the stat that shocked me most:

66.7% of software buyers purchased from a vendor they’d previously evaluated and bought from. Another 18.9% bought from vendors they’d evaluated but didn’t purchase from before. Another 11.1% used the vendor at a different company.

Do the math: that’s 96.7% of deals going to vendors the buyer already had some experience with.

“Building brand awareness” isn’t fluffy marketing bullshit. It’s the entire game.

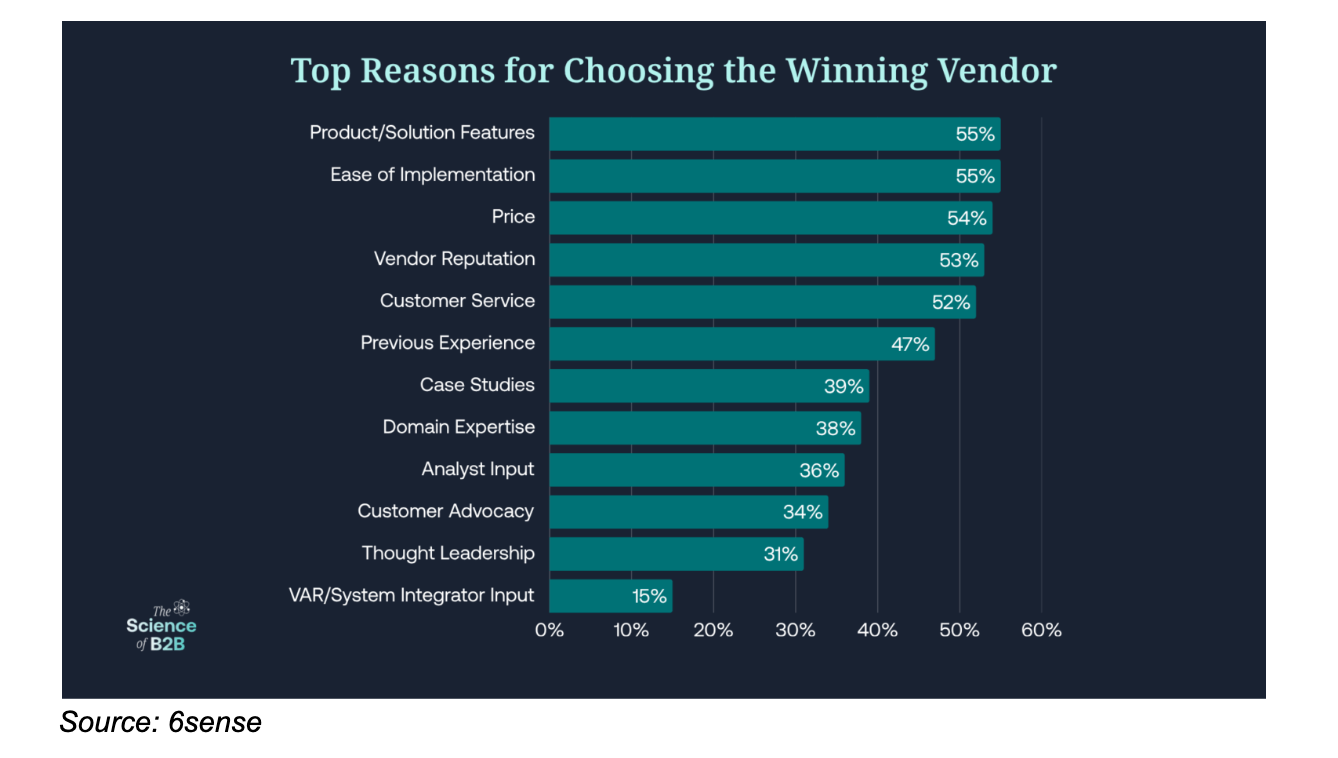

And once your brand passes the familiarity test, here’s what buyers say matters most:

The Trust Architecture Has Shifted

At decision time, buyers now trust GenAI chatbots (17.2%) more than salespeople (8.8%). Let that sink in.

The hierarchy of trust now looks like:

GenAI Chatbots (17.2%)

Software Review Sites (13.4%)

Peers/Colleagues (13.0%)

Your Website (12.6%)

Your Salespeople (<8.8%)

Sales hasn’t lost its role. Buyers still engage an average of 16 times with their chosen vendor. But sales is now about not losing the deal, not winning it from scratch.

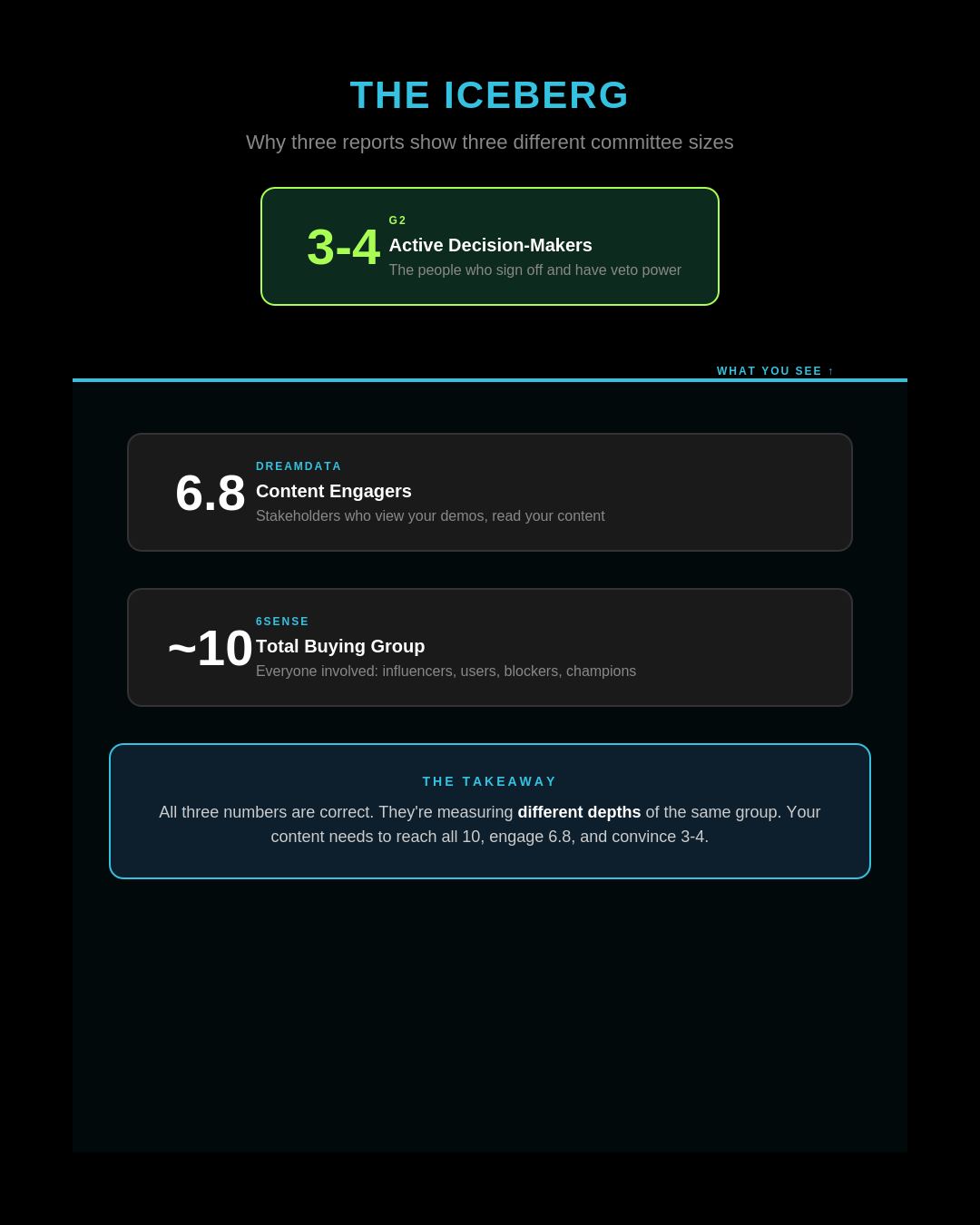

The Buying Committee Paradox (Resolved)

Here’s where the different pieces of research seemed to contradict one another: G2 says committees are shrinking to 3-4 people. 6sense and Dreamdata say they’re expanding to 10+ stakeholders.

Both are right. Here’s what’s actually happening:

Source: Electric B2B/New North

There’s a Core (3-4 people) who make the functional decision: “Does this solve our problem?” They care about speed, ROI, features.

Then there’s the Blast Radius (10+ people) who enter later: Security, Legal, IT Ops, Finance, Procurement. They don’t care about features. They care about SOC2, GDPR, and whether you’ll get them fired.

You need two parallel messaging tracks—one for each group. Track A focuses on competitive advantage and ROI. Track B focuses on security documentation and compliance frameworks.

Failure to address Track B is why deals “slip” at the last minute. The Core wants to buy, but the CISO blocks it because your security documentation was insufficient.

What This Actually Means for Your 2026 GTM

Five priorities that should be in every GTM conversation:

1. Win Before First Contact If you’re not on the Day One shortlist (80% win rate), you’re fighting for scraps. Shift resources from late-stage sales optimization to early-stage brand presence in dark funnel channels.

2. Build for the 107-Day Zone Stop over-indexing on SDRs. Deploy capital into nurture infrastructure that sustains presence for 3-4 months without burning sales capacity.

3. Optimize for AI Validation, Not Discovery Your AI presence depends on review site dominance. Fresh, high-quality G2 reviews feed the LLMs making recommendations.

4. Dual-Track Messaging 3-4 people make the functional decision based on features/ROI. Then 10+ compliance stakeholders enter to veto based on risk. You need content for both groups.

5. Measure Cost Per Company Influenced With 211-day journey lengths, short-term ROAS is meaningless. Marketing ROI calculations must look back 2-3 quarters.

The Bottom Line

The game is won or lost before sales contact.

Your job isn’t to convince buyers in the demo. It’s to be on their shortlist when they’re ready to buy three months from now. That means being visible, credible, and easy to validate in the channels where buyers actually research—peer networks, review sites, your own content, AI tools.

Most companies are optimizing the wrong 20% of the journey. The other 80% happens in the dark, outside your CRM, beyond your attribution model.

The full synthesis has all of this plus:

Complete channel performance benchmarks (LinkedIn vs Google vs Meta)

Demo engagement patterns that predict close rates

The exact times/days buyers engage with content

How to resolve every contradiction in the research

9 specific action items for GTM leaders

Download The State of B2B Buyer Journeys - What 14,000 Buyers Teach Us About GTM in 2026

21 pages. 5 data tables. 14 infographics. The only document you need to read to understand how buyers actually buy in 2026.

Everything else is noise.

—Dan Renyi

P.S. This research synthesis is sponsored by New North, a marketing agency that specializes in building high-ROI buyer journeys for scrappy B2B teams. They handle the full stack: content, paid, ABM, ops—and are really good at the 107-day nurture infrastructure that actually converts in 2026. If you’re tired of agencies that talk and don’t ship, check out newnorth.com.

P.P.S. You’ll be hearing more about New North from me pretttty soon - we’ve got some exciting stuff ahead.

Amazing post! I just drafted observations and have scheduled the LinkedIn post to go out Monday morning EST

Thanks Dan.

These are great insights, which should be read by anyone interested in GTM.

A very refreshing break from subscriber counts and strategies slop.